How can tech startups really make a difference in the world?

Just ask Cecile Blilious.

How can tech startups really make a difference in the world?

Welcome to The Innovation Equation, which explores the intersection of technology, society, and startups.

How can tech startups really make a difference in the world? Just ask Cecile Blilious.

I had the opportunity to speak with Cecile, Head of Impact and Sustainability at Pitango VC, who has passionately dedicated her efforts to growing the impact movement and bringing it into the traditional venture capital and tech world. She is one of the few people at a mainstream, generalist VC firm who works full-time with entrepreneurs to help them think about how their solutions can create even more benefits than they ever imagined.

Startups and investors always talk about building the future, but how can they make a tangible impact? More mainstream VCs are allocating space to “impact investments” in their portfolio, and consider ESG when evaluating new startups. But, how can founders and investors think about how to approach impact in radical and unconventional ways? Cecile reflected on her learnings from years of working with mainstream tech entrepreneurs to find the impact angles in their pitch and product, often to their surprise, that actually results in practical outcomes over the long-term.

˚。⋆ Making impact mainstream ⋆。˚

Standards and metrics are emerging for evaluating impact, especially in the global tech and startup scene. However, according to Cecile, the tech world is still behind. She mentioned that the European Union’s Sustainable Finance Disclosure Regulation (SFDR), which provides a global mandate for investors to classify their funds based on the extent to which they consider ESG and sustainability risks, still struggles with impact and traditional VCs. Many tech startups can have a positive impact on the planet, even if they are not intentionally seeking to create change as “impact Native” startups are. With the right support, these tech companies can do more using the product and vision that they already started out with. This also applies for mainstream tech VC funds, which may briefly consider impact and ESG during due diligence, but can go deeper, providing companies with relevant resources and strategies to maximize their impact potential.

First, Cecile discussed the ABC methodology which Pitango uses (developed by IMP, the Impact Management Platform) for initial screening of companies, which stands for Avoid Harm, Benefit Stakeholders, and Contribute to Solutions. Companies that do not Avoid Harm, such as those in industries including oil and gas, tobacco, weapons, harmful substances etc., might have ESG policies to improve some outcomes, but will be disqualified for investment as they might be creating negative, rather than positive impact through their core product. These companies will not be included in Pitango’s portfolio. Companies that fall into the B and C categories can look to integrate both impact and ESG. For example, Cecile noted that a company in the Benefit Stakeholder category could include a company that is seeking to optimize customers’ cloud usage, which has direct environmental and energy-related impacts that they can explore further, even though they are not an“impact Native” company.

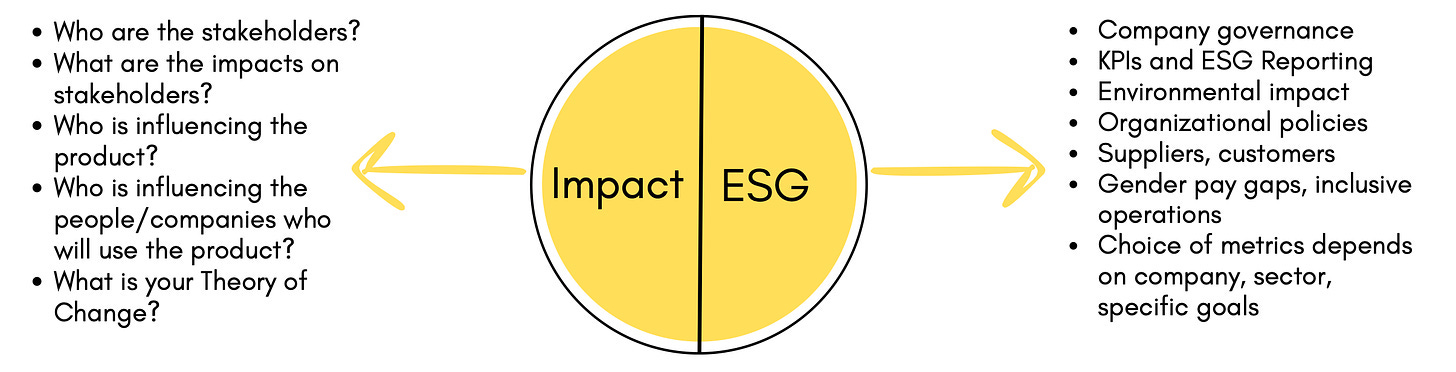

It’s also important to clarify the difference between impact and ESG, which are often used interchangeably. Impact is external, and involves intentionally thinking about all the stakeholders (human and non-human) that are affected by the product and business. It is a lens and mindset that leads to new ways of thinking about the startup’s mission and product, and can help shape a company’s internal ESG strategy as well. ESG, on the other hand, is internal, and refers to what it means to run a good business. This is the checklist and general best practices ranging from leadership behavior, diversity, inclusivity, carbon emission, addressing human rights across the board, and other regulations and compliance standards for overseeing a startup’s operations.

For generalist VCs who are not impact focused, Cecile noted that it is certainly fine to invest in companies that don’t necessarily have an impact with their product, as long as they apply high ESG standards and keep improving on them. “Our world needs products of all kinds which don’t necessarily create impact but are still needed and are good businesses. For those companies, managing themselves under ESG criteria is key, and for Pitango, as long as they are in the Avoid Harm category, we will invest in them”. Ultimately, screening the companies and understanding their potential impact is key to prevent any form of greenwashing.

˚。⋆ Start thinking about impact now ⋆。˚

Sometimes, the founders that Cecile meets with are just “two entrepreneurs and a Powerpoint presentation”, and they might not see why ESG is relevant at the early stages. But, Cecile emphasized that considering both impact and ESG at the initial stages is essential. Adopting an impact lens early on can help refine the product vision, help with market validation, and contribute to responsible product design. The notion of impact provides a framework that allows the startup to uncover new opportunities to better address the problem at hand using the solution they have already developed. With ESG, the founders can construct and integrate their values into their company culture, and create their initial plan and strategy that address other aspects of company-building, to prevent running into problems later on when they have scaled their teams to 30, 40, or 50 people. It prevents gaps that will need to be remediated later, providing a long-term vision for anticipating potential issues from gender pay gaps, environmental harm, company culture and behavior, etc.

For startups branded as Impact-Driven, there is a dual focus on both ESG (for internal practices) as well as external (product impact). Those startups focus on running a good business and intentionally maximize the benefits from their product, even if they are not Impact-Native startups that align with typical “impact investment” categories.

So far, according to Cecile, impact and ESG have generally been addressed separately, but in fact should go together.

Source: The Innovation Equation

˚。⋆ Connecting the dots - what is your theory of change?⋆。˚

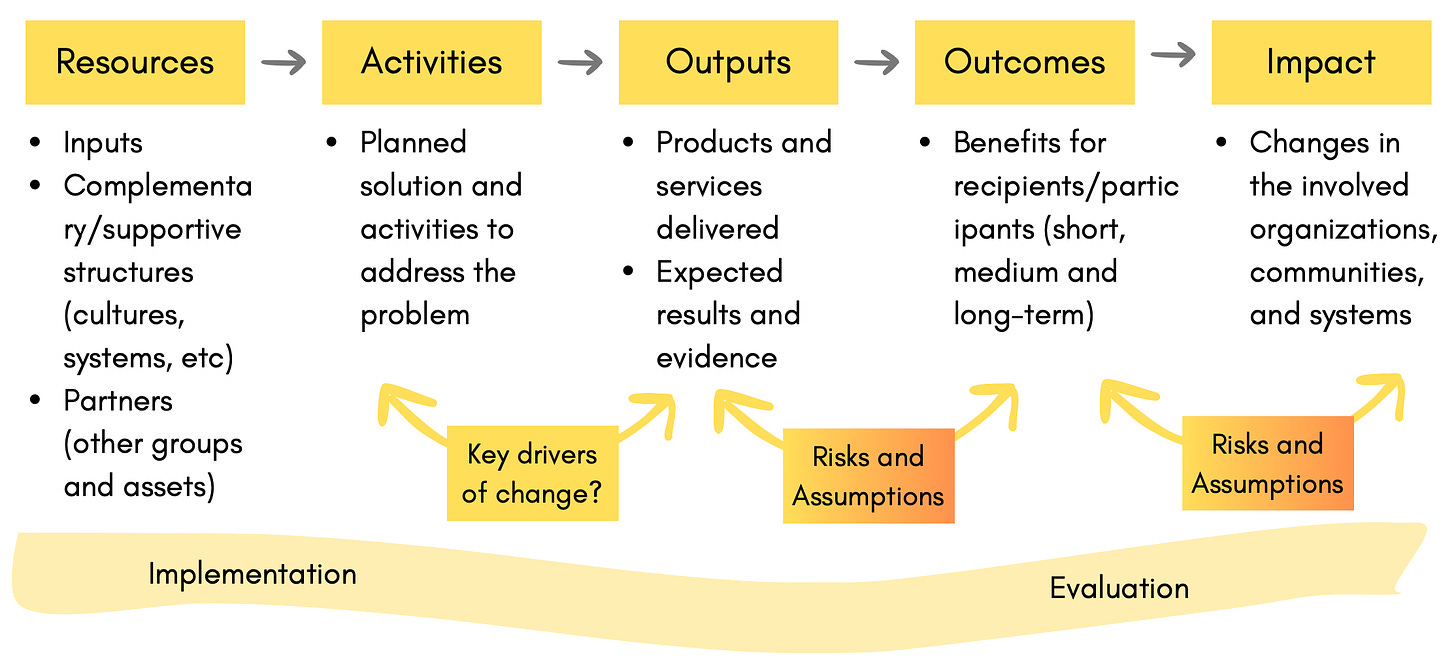

A key component of a company’s approach to impact is their Theory of Change, which will help founders understand the impact of their products, and build a good narrative and action plan linked with the Sustainable Development Goals. A company’s Theory of Change is a model of how their strategies and actions will lead to certain changes, and the assumptions behind these decisions. It traces the inputs (human, social, financial, material), activities, deliverables, and long-term outcomes that result, both within and among organizations, individuals, communities, and stakeholders. At each stage, the indicators and evidence are provided, and the logic behind the “if X then Y occurs”, are mapped along with the underlying assumptions and potential risks.

Source: The Innovation Equation

There are various ways that founders can construct their company’s Theory of Change, but a key component is to map the wider connections and influences in their model. This includes the founders’ priorities, mandates, vision, collaborators, and dynamics in their immediate ecosystem. The ultimate goal is to clarify the inputs, activities, outputs, and how the outcomes for stakeholders will create tangible, rather than theoretical impact.

Even within the impact and ESG movement itself, ideas about what is a “good” outcome can be biased due to individual social and political views, and the incentives of standard-setting organizations. At the end of the day, as Cecile aptly put it: “If you believe in human rights, then you don’t get to choose”. Cecile also mentioned that many companies that are rated highly for ESG still cause harm. Examples are in the domains of natural resources, arms, tobacco and electronic cigarettes and others. Therefore, firstly avoiding harm and integrating impact in a meaningful way is still important, as ESG does not cover everything. The Theory of Change model provides a means to dig deeper into high-potential opportunities at the early stages of product and company building, their implications, risks, and contribution to the startup’s overarching goal.

“With this, founders can really find their product market fit better, understand their stakeholders - who are not only their customers - in a way that helps them figure out what the pain is, for whom, and how big, or the five dimensions of impact.”

- Cecile Blilious

Source: Pitango ESG Report 2020-22

A key part of Pitango's approach that Cecile described is the ESG-SDG Continuum, which was created to align startup ESG practices, and where relevant, with the Sustainable Development Goals. Cecile works with founders to identify gaps in their ESG practices (such as diversity, carbon emission and governance issues) and work on improving on all metrics. With companies that have a potential to create positive impact (“Impact Driven”), they identify the relevant SDGs, match these goals with the product expected outcomes and integrate an impact thesis throughout company operations.. Pitango tracks performance on these targets and Cecile provides founders with the relevant tools and support to improve these outcomes over time. More broadly, implementing the ESG-SDG Continuum approach also helps promote customer and talent attraction/retention, access to resources and capital reserved for impact Native companies, alignment with global standards and IPO/M&A deals, and more.

At Pitango specifically, the investment team and Cecile also consider:

How is the company applying ESG metrics in its operations? Is the company team ready to apply ESG standards and KPIs?

With “impact driven” companies, is there alignment between the business model and potential impact?

What are the impact targets and risks? Impact targets include the market size, global potential, comparison with current solutions, and influence on other stakeholders to create change. Impact risks include the evidence for tracing impact, ability to deliver on goals, efficiency, execution, and unexpected impacts.

Is the Theory of Change clear and does it thoroughly address stakeholders and KPIs?

Are there guardrails and mitigation measures in place for the different risks?

Are there basic policies for ESG areas (materials and energy consumption, governance, stakeholder management, etc)?

Are there additional benefits, such as reaching lower-income market segments, improving the policy environment, de-risking new business models, and building new ecosystems for innovation?

For investors and founders, you can find Pitango’s screening criteria related to impact and ESG here: Investment Process and Management

˚。⋆ The role of AI in the impact world⋆。˚

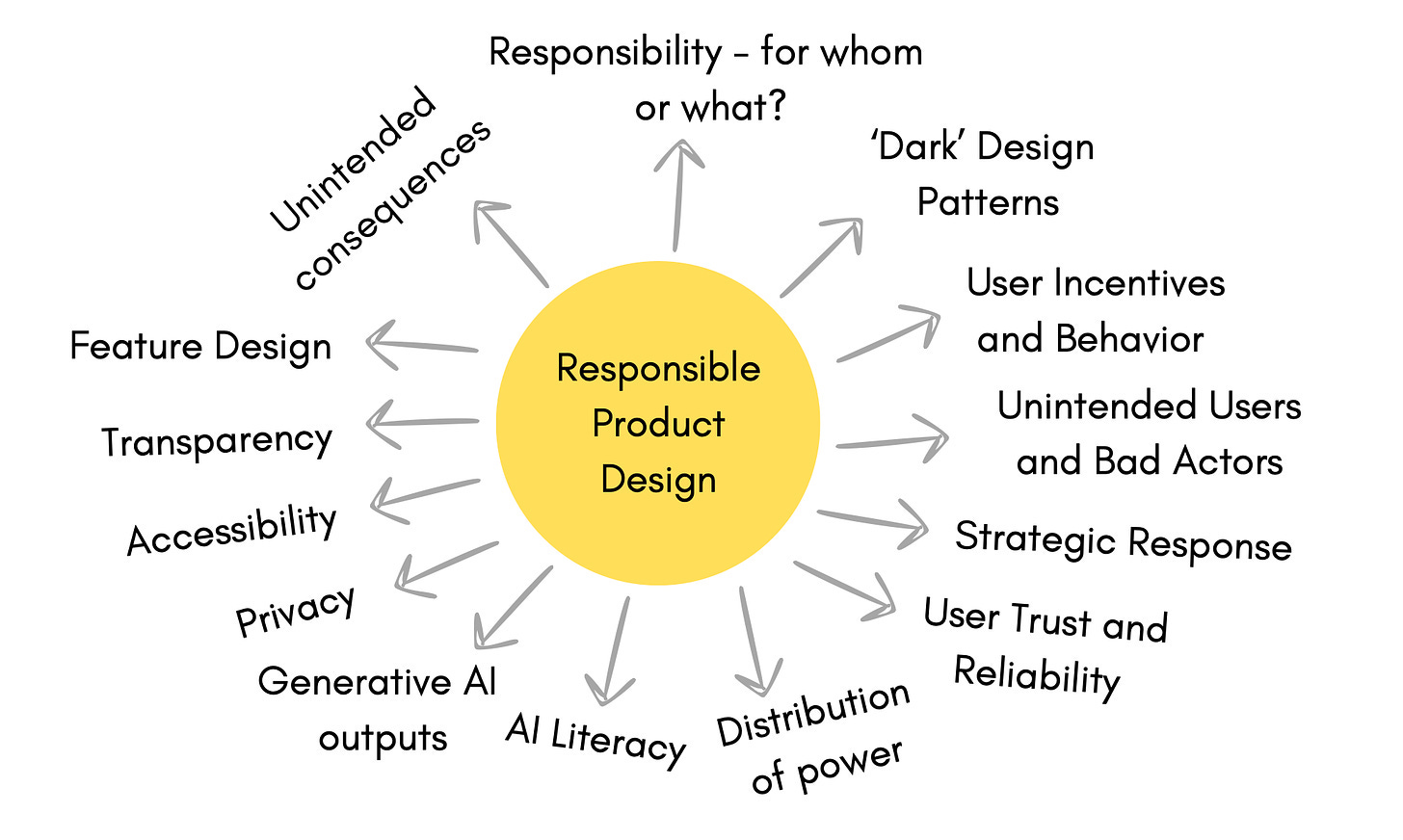

Over the past year, generative AI has exploded across enterprise and consumer use cases, making Impact-driven tech even more critical. Cecile made it clear that companies across industries will fail unless they integrate AI in some part of their business, otherwise making it impossible for them to be competitive. This is where responsible AI, and more broadly, responsible product design is intricately tied to impact and ESG. The use of generative AI can either enhance impact efforts, or exacerbate the problem and create new ones. This includes everything from suppliers, infrastructure, data sources, consent and ethics in data collection, and AI development that has implications for privacy, bias, user trust, and intellectual property. Cecile also pointed out that responsible product design is an important aspect that both startups and investors should ask questions about. For example, VCs can consider the use of AI assessments during the due diligence process.

Source: The Innovation Equation

Some questions to consider for reflecting on Responsible Product Design include:

What are the unintended consequences of the product?

Is the data-set upon which the AI is trained approved for use by regulation and privacy laws? Can there be a risk of skewed data which will result in harmful products?

What are the psychological and behavioral underpinnings behind feature design choices? What kind of user behavior do they encourage or discourage?

What are the emerging policies, laws, and standards in AI and for the use of AI in the company’s use case and industry?

What are the social considerations that are not covered by current standards and frameworks? For example, changes in user behavior, social norms, and work practices.

Are there potential risks for increased automation? What are the implications for the economy and labor market?

What are the security or safety risks across cybersecurity, privacy, and user data?

Is the system designed to anticipate and prevent actions taken by bad actors?

What are the preventative and strategic response measures in place to address unforeseen situations?

˚。⋆ Final advice for founders ⋆。˚

”Companies have to look at what impact they have on the world, and how they’re going to apply it. This is true for issues such as hiring diverse talent, reducing their harmful impact on the planet and governing themselves well. Even more so, it is true for startups that create solutions that can address the world’s biggest social and environmental challenges. They have to look at the product outcomes that are related to the Sustainable Development Goals and how they can make their narrative and understanding even stronger, so that impact becomes a part of their DNA.”

- Cecile Blilious

In order to blend impact into the solution, Cecile made it clear that ideas do not need to be far fetched or theoretical. She has worked with Pitango portfolio companies across sectors that have successfully implemented impact and ESG approaches. For example, Masterschool, an edtech company, tracks student progress and cohorts in alignment with the SDGs to prevent biases related to gender or lack of formal education. Tomorrow.io’s weather intelligence platform addresses everything from flooding risks for critical infrastructure to route optimization for transportation companies. They also seek to reduce data center and server emissions, which is a driver of tech companies’ environmental footprint. Finout, a cloud cost management tool, has strengthened its focus on sustainable energy initiatives by providing visibility into carbon proxies and emissions in addition to costs.

Cecile explained how she works with founders, and helps bring out new ideas that they never thought of, but are excited to adopt:

Can you describe the problem you’re solving through a social or environmental lens?

Pitch your idea, but now consider the different stakeholders involved. What is in it for them?

What are the new ways that your solution can address the problem?

What are the positive and negative consequences involved?

What are the outputs and outcomes for each stakeholder of the company and product?

How has this changed the way that you view your market, product, and solution? What are the new ideas that emerge for enhancing your initial solution?

For Impact Natives, Cecile said the challenge will be to build an ESG compliant company with high standards, as many do not fully address it. However, the biggest need of the hour is focusing on all of the other companies out there, and the new early-stage startups in the tech sector. For these companies, there is great potential to be Impact-Driven. This means exploring how they can tackle a problem from different angles, drawing from diverse disciplines, knowledge, and research, and distilling it into actionable steps. These ideas need to be clear, measurable, and aligned with stakeholders so that, in Cecile’s words, “everybody speaks the same language”. While the metrics, measurements, and evaluation frameworks will also depend on the sector, stage, and the company’s problem and solution, there are now even more resources and tools available for founders to experiment with. Even though this is an emerging space, Cecile’s insights and strategies provide more than a starting point for founders at all stages to think about the change they really want to make in the world.

Further reading:

The Five Dimensions of Impact - Impact Frontiers

ESG & Impact Knowledge Hub - Pitango Ventures

GITA - Global Impact Tech Alliance (Masterclasses + Resources)

Check out more of Cecile’s work through her blog, and Pitango Ventures.

What do you think? Are you working in an early-stage venture looking to explore impact? Reach out, leave a comment, and keep in touch!